THE CASE FOR DIRECT COMMERCIAL REAL ESTATE INVESTMENT

At Trinity, we are unabashedly passionate about investing in real estate. And for good reason—including real estate in an investment portfolio leads to better overall performance. In addition, real estate offers several unique features and elements that investors find attractive. Pension funds, institutional investors, sovereign wealth funds, and family offices all invest in real estate—and it often makes up a material component of their investment portfolio.

However, getting from “yes” on real estate, to a properly risk-adjusted portfolio requires a good understanding of the investment options, coupled with a carefully identified risk tolerance and enumeration of investment return requirements. For family offices in particular, the type of ownership is also a decision factor. There are benefits of direct ownership that should considered—as they can often help attain long-term strategic goals and objectives not found elsewhere. This paper provides a foundation for the rationale of real estate investment, together with a description of strategy formulation and property/class characteristics. Lastly, we identify several benefits available by owning real estate assets directly.

In the modern era, real estate has become a significant asset class, with broad and diverse ownership. Globally, commercial/investment real estate is valued at approximately $14.45 trillion, comprising approximately 10.6% of the investment universe.[1] Of this total, approximately $7.7 trillion is equity (53%) with the balance (47%) as debt instruments. We see a higher debt ratio when looking at the U.S., albeit the available data excludes smaller portfolios and private ownership, yet includes private and public debt. Given these constraints, the U.S. national market for real estate is estimated at approximately $7.5 trillion--$2.5 trillion identified as public or private equity[2]. As an asset class, real estate offers a breadth and depth of investment opportunities.

[1] AON Shang, Gillani, Attaluri “Global Invested Capital Market”. (February 2021).

[2] Greg MacKinnon, Pension Real Estate Association (PREA), “Why Real Estate” Updated Q4 2021.

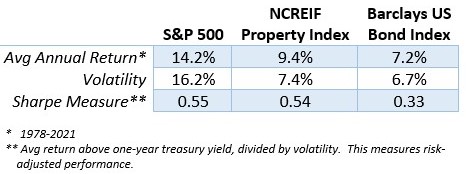

The growth and scale of commercial investment real estate is largely attributable to the multiple benefits it brings to a balanced portfolio. These include complementary portfolio returns, a ratable income stream, diversification, tax (timing) benefits and an inflation hedge. Historically, real estate returns have balanced between equities and bonds, providing a strong complement to an overall portfolio return.

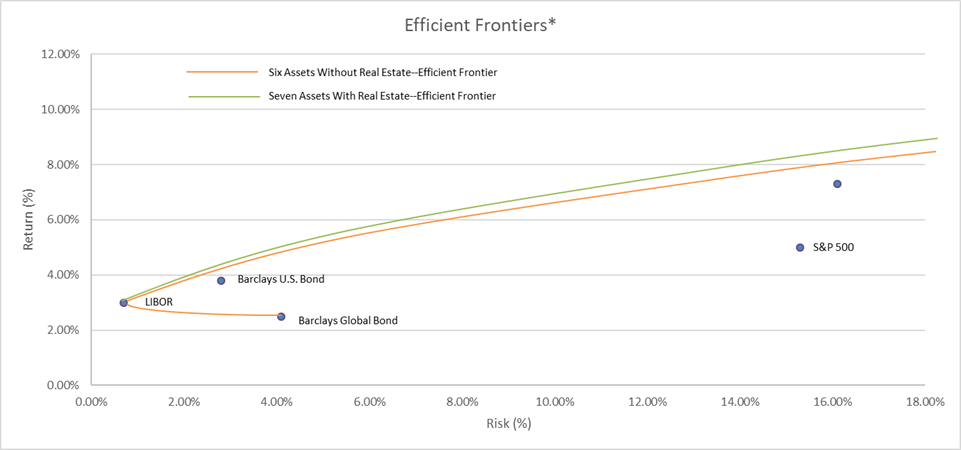

This complementary return element creates an important contribution to portfolio performance. When studied over time, balanced investment portfolios that include real estate perform better. The corollary is also true—including real estate allows for attaining a performance benchmark (holding all else constant) with less risk. Often referred to as an Efficient Frontier Analysis (part of modern portfolio theory), it incorporates the respective returns and risks for each of the investment assets held in a portfolio. There have been multiple studies reviewing real estate in this regard, and the consensus indicates the addition of real estate improves performance and/or reduces risk. The following (example) chart highlights the impact of including real estate within a portfolio as studied by Lazard Asset Management.

*Lazard Asset Management, “The Impact of Real Estate Allocation in a Diversified Portfolio”, 2014.

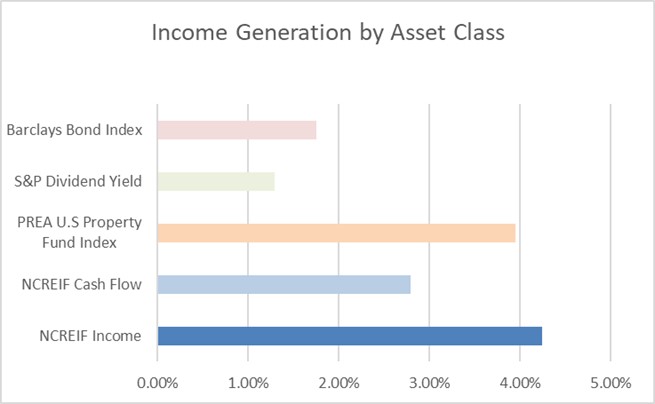

Improved returns are only part of the story. Another benefit of real estate is its income (cash flow) component. While the following table is a representation of recent returns (and reflective of our current low interest rate environment), it demonstrates the relative benefit of income and cash flow from real estate holdings.

Source: PREA, “Why Real Estate”, Q4 2021 Update Presentation

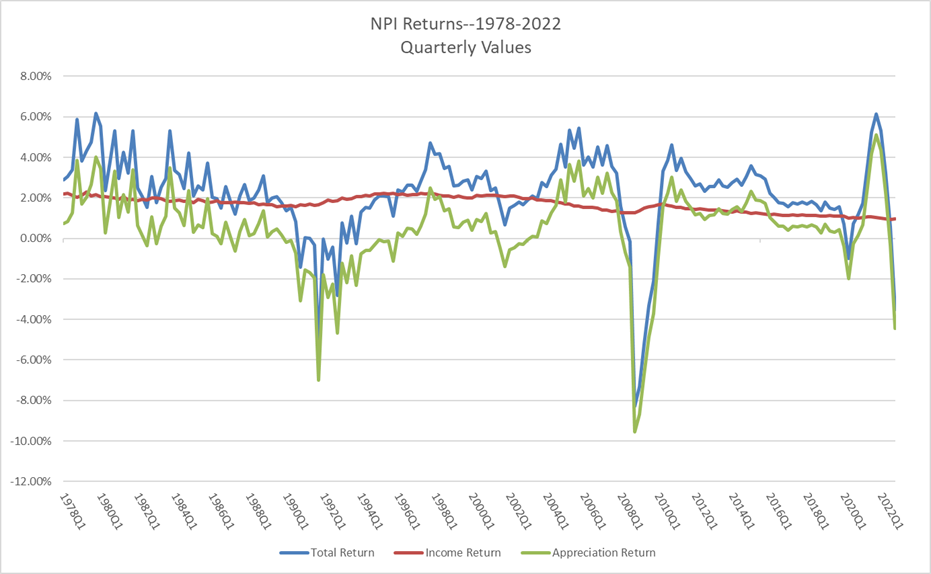

The income component helps reduce some of the volatility that may otherwise be present in a portfolio more heavily weighted to equities. For example, looking back over three decades, the income component of total real estate returns has remained relatively steady. The following chart indicates the income, appreciation, and total returns for NCREIF’s Property Index (NPI) for the period 1978-2022[1]. This data set is reported quarterly, and is presented as such (they are not annualized returns). Also, the NPI represents private, commercial real estate assets primarily acquired on behalf of tax-exempt institutional investors and held in a fiduciary capacity. It is worth noting that the NPI data is adjusted to an unleveraged basis, and generally includes “core” or relatively low risk assets.

[1] NCREIF Indices Review, Current Data

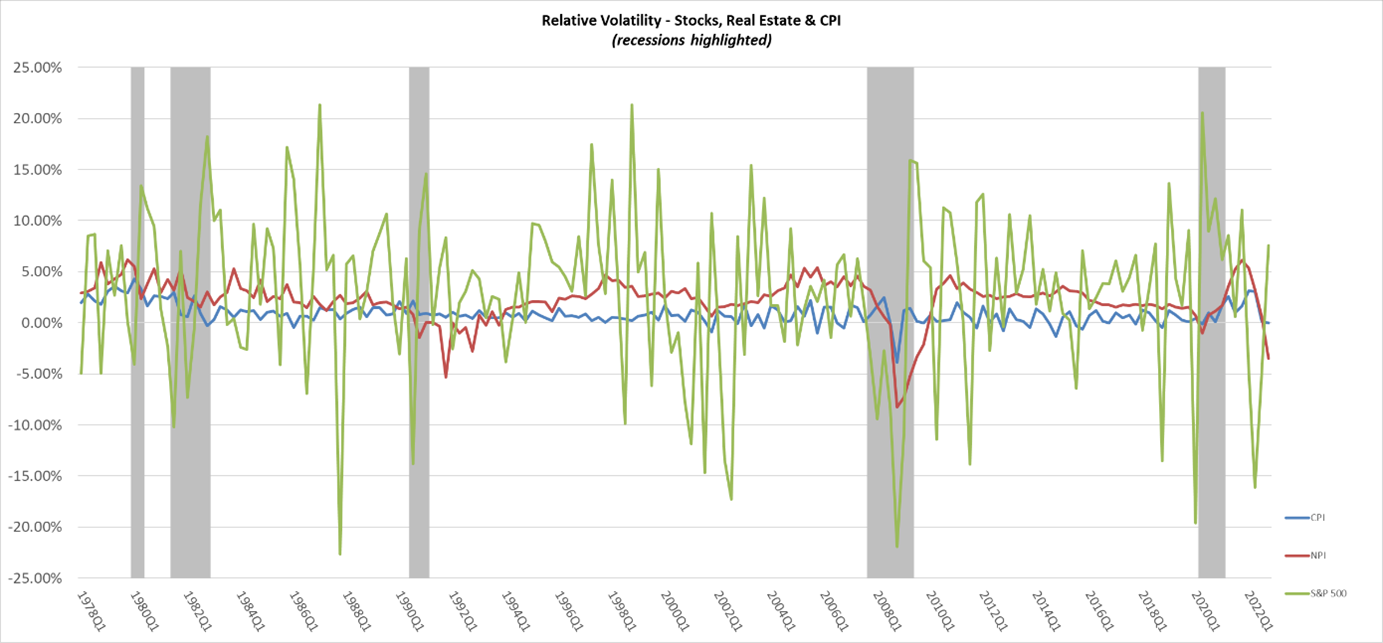

At the same time, volatility of total real estate returns is far less pronounced than equities. Looking at quarterly returns for the S&P 500 vs. the NCREIF National Property Index provides a vivid demonstration of the reduced volatility with real estate assets. The green line on the following chart (S&P 500) shows dramatically wider swings than the more stable NPI returns as shown on the red line. It should be noted using the NPI data necessarily skews the reported real estate returns in a downward direction somewhat as the assets in the reporting database are generally lower risk, well-located, fully leased, stable, institutional-grade properties with little or no debt. Including real estate assets in secondary markets or that were more opportunistic would likely impute a somewhat greater volatility. Nonetheless, the combination of relatively stable income (from longer term tenant leases) coupled with modest value changes leads to stable overall return and trend. The change in CPI is also identified within this chart to show the respective correlation with inflation levels.

Source: NCREIF, Bloomberg, U.S. Bureau of Labor Statistics

We believe the case for a real estate investment within a broader portfolio is therefore compelling.

There are, however, myriad ways of investing in real estate across a multi-dimensional spectrum of risk and product type. Like all investments, real estate should be evaluated based on its actual and anticipated risk-adjusted return(s). Understanding risks allows for an investment strategy that can both meet long term objectives as well as retain alignment with risk tolerance. Real estate investments broadly fall into four risk categories—with increased return expectations aligned with increased risk.

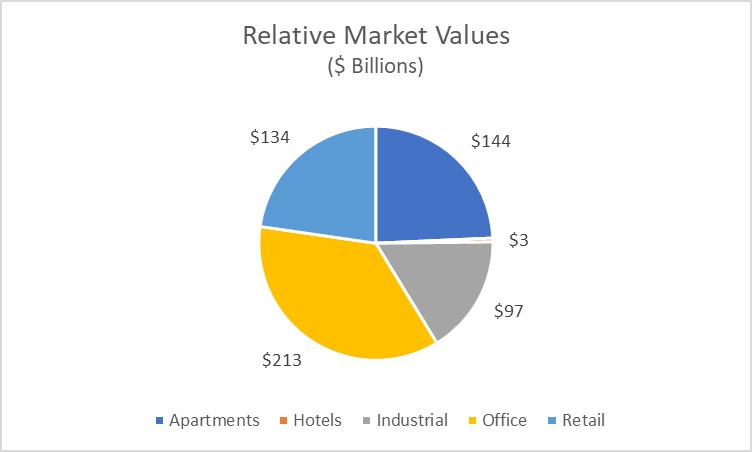

These risk classes can be further defined based on the product or investment type. Broadly speaking, the major real estate product types are office, apartment (multi-family), retail, and industrial. These comprise the majority of the investing segments in the U.S. and globally. Smaller segments include hotel, self-storage, student housing, senior housing, medical-office (including subsets such as dialysis clinics), timber, and agricultural lands. The big four of apartments, office, retail, and industrial are dominant. The following chart provides a relative proportion of how institutional investors have made their investments in the U.S. markets.

Source: NCREIF National Property Index, 3Q18.

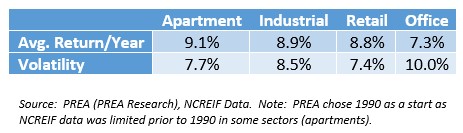

Note the investment universe includes opportunities in each of the major risk categories for each of these major asset types. For example, there are opportunistic apartment projects (new development or significant re-development) as well as core office investments (new, high-rise in growing urban areas such as Seattle). These product types also have differing characteristics that should be recognized with respect to investor risk tolerance and portfolio performance. One of our best examples of this is the office product. With long term leases comprising the bulk of the generated income stream, office investments are also subject to required capital investments associated with tenant turn-over—specifically tenant improvements and commissions. New (and renewing) tenants will typically want a significant landlord contribution to tailor the office space to their needs. Over time, this necessarily creates swings in the property’s distributable cash flow. More recently, we’ve seen the impact of post-pandemic office demand coupled with work-from-home (WFH) feasibility combine to cast further uncertainty for future demand. Apartments tend to be more management intensive, but also benefit from relative vacancy stability and low turnover costs. As noted below, office (for example) has had the lowest returns and highest volatility over the 28-year period from 1990 to 2017.

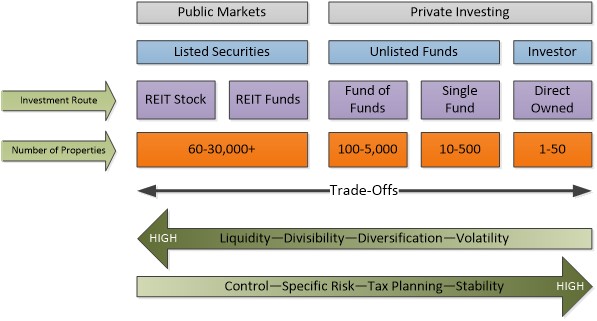

The options for investing are equally wide, and each carries some trade-off to investors. These factors include liquidity, control, investment volatility & correlation with other asset classes, tax planning, and diversification. Largely speaking, the investor has three major options: the public markets (Real Estate Investment Trusts—REITs and funds of REITs), private (unlisted) funds, and direct ownership. For comparative purposes we are excluding mortgage REITs as these offer a differing risk/return threshold and are more closely aligned with the debt markets and the risk-adjusted returns of debt instruments. Also, we are not including a review of the differing costs for managing each investment option. Our research in this area indicates the total management and administrative costs do not differ dramatically among REIT, private funds, or direct investing options within similar risk categories. Costs tend to be higher for more actively managed portfolios or assets with higher return (and risk) characteristics. This is not to say that costs should not be viewed carefully—they should—but the narrow range of each in general suggests they are not key influencer in reviewing the differing investment options.

Investing in the public markets (REITs and funds of REITs) is relatively straight-forward and offers a number of benefits. This option provides one of the easiest methods to create an immediate investment. As a traded security, they offer daily liquidity, good transparency, sector diversification (number, location, and/or type of properties) and a relatively low commitment level. At the same time, their investment performance tends to tie more closely with the broader equity markets—meaning they have a greater volatility with respect to total portfolio performance. They also offer little flexibility for tax deferral or tax planning.

The use of private funds provides some of the diversification and scale benefits of REITs, while often allowing for a more targeted risk strategy. Specifically, there are many investors looking to complement their portfolios with higher return metrics available with value-add or opportunistic funds. Funds are typically defined by risk, and identified consistent with the definitions of core, core-plus, value add or opportunistic. Benefits of fund investing include good sector diversification (scale), a defined strategy/approach and dedicated professional management. At the same time, they also require a greater commitment level than the public markets, have limited liquidity and control provisions, and little, if any, ability to engage in meaningful tax planning.

Which takes us to the direct investment option. Direct investing provides a number of benefits not available within the public (REIT) or private fund structure. These include full control of the asset, tax deferral(s), full transparency, true portfolio diversification, and multi-generational income and value-preservation. Control provisions are worthy of identification as they in effect dovetail with some of the other benefits discussed. Under direct ownership, the investor has full control regarding its operation, financing/debt levels, and planned hold period. Owning direct real estate allows for the tax benefits of both asset depreciation and deferral of taxes even on a sale/gain.[1] Ownership and close monitoring by the asset and property managers allow for frequent and accurate reporting of the property’s performance together with periodic reviews of extended, longer term (10-year) performance and modeling. Interestingly, the illiquidity of direct-owned real estate is often also viewed as a benefit. When looking at a multi-generational investing strategy, including direct-owned real estate creates a natural barrier to the “quick sale” or what may be an undesirable liquidation and distribution of assets.

Direct ownership of real property also uniquely creates an opportunity to demonstrate and translate family values. There is something to be said for owning a “pride of ownership” asset. They are often widely respected and treasured—by both families and communities. The quality of a property and its presence in the market can often translate to the quality and “permanence” of the family. And there is often much more. A key refrain we hear often is the need to transfer family values to future generations. Those of integrity, hard work, creating value, and community. This can be challenging when looking at a stack of investment return reports and account statements. Visiting real properties, however, provides an exposure to real world assets. Seeing first-hand how a coordinated team is required to run a property is very educational. Property managers, leasing experts, maintenance engineers, landscapers, housekeepers, and of course all the suppliers and outside maintenance staff contribute to a successful property. And, of course, there are ultimately the customers (tenants) who must be well served in order to retain them and pay the rent.

[1] Assuming the investor successfully uses a §1031 tax-deferred exchange to a like-kind property and investment.

Trinity Real Estate

Since 2001, Trinity Real Estate has provided guidance and service to family offices, and organizations throughout the Pacific Northwest and to institutional investors nationwide. Our principals have acquired, managed, developed and repositioned more than $9 billion in assets, and our expertise spans all sectors of real estate.

The Author

Since founding Trinity Real Estate in 2001, Richard has provided advisory, development, and investment services for real estate investments valued at more than $2 billion. Under his leadership, Trinity’s product experience totals more than 4.6 million square feet and includes office, residential, retail, hotel, mixed-use, and industrial properties.

As an industry expert, Richard has been referenced in the New York Times and has been a contributing source for the annual Urban Land Institute/PricewaterhouseCoopers Emerging Trends publication. He is an active member in the Forbes Finance Council, served as President and Director of the Pacific Real Estate Institute and is both a past President and former national board director for the National Association of Industrial and Office Properties.

He graduated from the University of Washington with a BA in Business and MBA in Finance, and completed post-graduate work at Oxford University (Templeton College) in its Advanced Management Programme.

Discover how we’ve helped clients like you on our Case Studies page. Get the latest news on what we’re up to here.