INTRODUCTION

At Trinity Real Estate we believe a well-structured ground lease can be a very attractive investment. A ground lease (or land lease) is an agreement between the landowner (Lessor) and the tenant/user (Lessee) that allows for long-term use (and/or development) of a property by the Lessee in exchange for a series of rent payments to the Lessor.

The concept of a ground lease has been around for most of recorded history. In the U.S., documents reference ground leases dating back to the early years of the country’s founding. Today, we observe that ground leases are becoming a growing segment of the commercial real estate marketplace and that their leasing structures are evolving.

We strongly feel that it is important for an investor to understand the advantages and disadvantages to a ground lease, affecting both the Lessor and Lessee. Thus, in this insight article we describe these elements as well as ground lease principles. This article is intended to provide an overview of a ground lease from the perspective of evaluating investment options and the creation of the agreement[1].

WHY CHOOSE A GROUND LEASE?

A ground lease represents an established, long-term investment vehicle that can provide benefits to both the Lessor (landlord/Landowner) and Lessee (tenant). For the landowner, a ground lease can represent a good option to capture the appreciated value of a land parcel and convert it to an investment vehicle with a consistent, reliable cash flow component.

We will often see an organization or family holding a “legacy” property for many years, or even generations, resulting in a significant appreciation in value. However, to realize this appreciation in land value there are only a few choices available to the landowner: (1) sell it, (2) develop it yourself, (3) potentially contribute it to a joint venture with a developer, or (4) create a ground lease.

The sales option is straight-forward, and there is a “best practices” approach to this option that should be carefully considered and understood to capture the highest value combined with a certainty of closing[2]. Any tax efficient reinvestment requires a concerted effort and understanding of the IRS 1031 Exchange rules (see Trinity’s Insight Article on 1031 Exchanges) A sale also means a complete disconnection from the property, which may be problematic if there are legacy connections to the site.

Development of the property by the landowner is also an option, however, it is often confronted with three key barriers. First, it is rare that the landowner possesses the full complement of development skills necessary for creating a successful project. Second, significant capital will be needed to develop a high-valued land parcel. Third, the development process contains significant risk, and both the returns and investor temperament must be appropriately aligned to be successful. Owning a well-located property is at the opposite end of the risk spectrum from embarking on a ground-up development.

Establishing a joint venture with a developer is also an option. The landowner would contribute the land parcel to a new joint venture entity. The developer then invests (or raises) the remaining equity and arranges for construction debt to complete the project. Naturally, development risk, which includes many facets (environmental, soils, construction costs, entitlements, schedule, marketing, and leasing, etc.) and a likely non-controlling voting position in the joint venture are elements to consider with this option. As noted above, owning well-located land has a different risk profile than a minority (non-controlling) investment in a development project.

The creation of a long-term ground lease is the final option that is available to a landowner to realize value increase of the land. There are several benefits to the landowner with this approach. First, it captures the current value of the land, by translating that value into an income stream. Second, by maintaining ownership, it allows continuity of control without creating a tax burden and can also create and maintain a positive impact to the local community. Finally, it maintains financial flexibility (the land lease can be sold, or borrowed against), at any point during the term of the lease agreement.

While this paper focuses specifically on creating ground leases for properties that are to be developed, ground leases can be created for already existing assets and many of the same terms and ground rules apply.

GROUND LEASE PROCESS

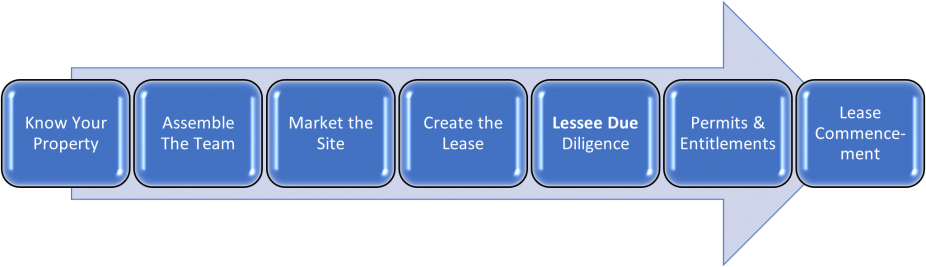

Once a ground lease is identified as a desirable objective, understanding the process to create the agreement is critically important. Providing clear communications, setting expectations for milestones (and timing), and providing team direction are all essential to create a successful agreement. The following illustration (specifically for creating a ground lease for a new development project) identifies the major steps/components in the process as well as the appropriate sequencing.

From the “go” decision to create a ground lease to the effective/commencement date, you can expect the timeline to be approximately 2 to 2 ½ years. Work on behalf of the landowner (Lessor) is really compressed and identified in the early stages of the process, through the completion of the prospective Lessee’s due diligence. Efforts then shift to the Lessee, who will be working to develop and manage all the materials necessary to secure the identified permits and entitlements.

Know Your Property - The importance of this step cannot be overstated since it allows for a full understanding of the development capacity (and/or limitations) of the site. We recommend contracting with a qualified architect to create a massing study (2-4 weeks), which should incorporate current zoning, applicable setbacks and height limitations, and any other impacts that would affect a delivered site. This study will provide the owner and the marketing team with an understanding of the potential capacity and value for the property, which will assist when negotiating development of the site.

Assemble the Team. We recommend assembling a team that includes the following skills:

Market the site - The marketing process encompasses gathering background information, identifying, and marketing to potential lessee, conducting site tours, coordinating offers, negotiating “best and final”, and Tenant/Lessee selection. The marketing process will likely take 90-120 days. It is typical for a lessee to sign a Letter of Intent, which will serve as the template for the actual ground lease.

Create the Lease - Using the Letter of Intent as a template, the lease itself will incorporate a myriad of elements that are necessary to meet the needs of both parties and can remain functional through its duration (typically up to 99 years). The timing to create and finalize the actual lease document can vary but the timeline is typically several months.

Lessee Due Diligence - Like purchasing any investment asset, the developer (lessee) will want to ensure they understand and have fully vetted what they will be leasing. This is usually allocated into three categories: physical, economic, and environmental. The physical is concerned with the boundaries of the property, qualities of the underlying soil conditions, as well as the zoning and land use affecting its current and planned/future uses. Economic issues relate to the local and broader markets for supply and demand, comparable land values/pricing, and of course overall economic feasibility of the anticipated development. Environmental investigations ensure a prospective site is free of contamination, and any factors such as soil condition, water table, and/or groundwater are understood and incorporated into the review. In most transactions, allowing 30 days to investigate these items is adequate.

Permits and Entitlements - In most cases with a high-value transaction, the developer will agree to “close” (or commence the ground lease) only when he/she can be assured they can build what they have underwritten. Given this, the developer/lessee will want to secure appropriate government approvals (entitlements) and/or actual building permits before committing to the lessee obligations under the lease. The timing for this work is extensive, often requiring 18-24 months or more.

Lease Commencement - This is the key milestone for all parties and usually is identified as occurring at the time of acceptance of the permits/entitlements approved by the relevant jurisdiction. Once commenced, the ground lease is then “in effect” and will govern the land itself for the duration of the agreed-to term.

KEY ELEMENTS OF THE GROUND LEASE

The elements within the lease itself, of course, comprise the bulk of the negotiation and hard work required to “Create the Lease” as outlined above. While every lease is unique, there are several common elements as part of the process.

Marketable and Financeable - At a macro level, a ground lease must be both marketable and financeable. To be marketable, it means the developed property, subject to the underlying ground lease, can be readily sold in the open market. More specifically, this means the lessee typically will want predictable rent and operating obligations for the duration of the agreement. Regarding financeable, the lease must allow for reasonable underwriting from a lender. In addition to underwriting the income and cash flows generated from the improvements (the building), a lender will also want to have full confidence in understanding the future underlying ground rent obligations.

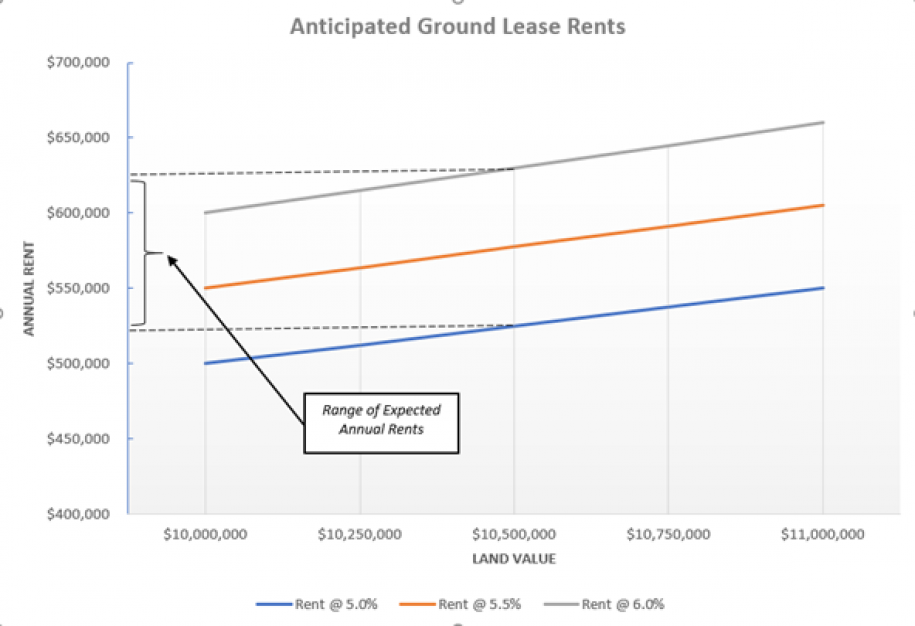

Establishing Rent - The determination of the initial rent amount is a typically a function of establishing the land value and applying a rate of return against that value. The initial land value calculation can be straightforward, although usually is a function of negotiation between the prospective lessee and the landowner. Nonetheless, it generally will fall within an anticipated range that would be reflective of an appraisal or valuation of its intended use. Usually, the rent is set at a level that allows for an accretive contribution to a development.

Expenses (Operating and Capital) - In nearly all cases, the lessee (tenant) will be fully responsible for all operating and capital expenses associated with the land. This includes insurance, real estate taxes, and all expenses associated with the improvements existing or constructed on the site. The lessee is also assumed to be responsible for all capital improvements associated with the building(s) as well as any that may be required associated with the land. Two areas that often merit extended discussions between lessor and lessee are environmental issues (contamination) and ongoing re-investment in the improvements.

Lease Term - The term (duration) for a ground lease has varied historically from the relatively short, to very extensive, multi-generational time periods. In recent times, there was a period where common law held to a maximum term of a ground lease at 99 years; the rationale being it represented a time span that was beyond the life expectancy of any possible lessee and/or lessor. While this concept no longer applies, the market application of typical ground leases has retained the term as a reasonable period to allow for performance between Lessor and Lessee. Common today, ground lease terms typically range from 55-99 years, although most lessees desire terms more than 75 years. In most cases a ground lease is structured to provide an initial term usually in the range of 49 years, with options to extend for additional periods.

Subordination/Seniority - Most ground leases are unsubordinated, which means they are not subject to any senior claims or ownership interest in the land itself. The lessee (tenant) cannot pledge the value of the land or provide any potential current or future interest in the land associated with any financing or investment interest. The land stands independent of the improvements.

Improvements and Lessee Obligations - As noted under the expense discussion, ground leases are largely “absolute net” in structure, where the lessee (tenant) is responsible for all expenses associated with the property. In addition, this usually also includes any capital expenditures mitigations, and even environmental issues to the extent they occur or are identified in the future. However, the landowner will want to have one or more mechanisms to ensure the improvements situated upon the leased land are similarly maintained in good order throughout the term of the lease. This serves to both ensure the value remains at the end of the lease term (reversion date) and there is a higher confidence that income will continue, allowing for ongoing, ratable payments of the ground lease obligations.

Costs, Expenses, and Potential Offsets - There are, of course, costs to create a ground lease, which can vary based on the complexity, proposed use and size of the site. The importance of assembling a high-quality team early in the process represents the complexity of the process and high values created. Design and advisor (legal, etc.) fees will exist early in the overall timeline. Sales/marketing costs are usually borne by the investment brokerage team and included in their fee structure. In many instances, in addition to the ground rent that will be payable at commencement, the lessor and lessee will come to agreement on a series of option payments (from prospective lessee to lessor) during the entitlement process. It is important to note that there are no payments or obligations during the lessee’s due diligence efforts. But, once the due diligence is satisfied, we often see option payments initiated. These payments can help offset (and usually exceed) any ongoing costs for legal and/or advisory services. Once the ground lease becomes effective, the regular ground rent payments begin.

Other Provisions - There can be several other provisions negotiated, depending on the circumstances of the lessor/lessee. These can vary from percentage rent provisions, which allows lessee to participate in the economics of the real estate, to provisions regarding future development on a ground leased site. In all events, it is helpful for the lessor/lessee to have appropriate counsel to navigate through the various complexities of this arrangement.

SUMMARY

While it is extensive, and often time consuming, creating a long-term ground lease can create significant and valuable long-term investment benefits for a landowner. In many cases a ground lease can uniquely meet the needs of retaining ownership while capturing value increases, without incurring significant risk or diluting a long-held interest. Structured appropriately a ground lease can be a beneficial investment for the investor. This article provides you a brief overview of all the elements that goes into considering, developing, and creating a ground lease. Please feel free to reach out to any of the Trinity Real Estate team members to answer your real estate ground lease questions or needs.

ABOUT THE AUTHOR - RICHARD LEIDER

Over the past 30 years, Richard has provided real estate advisory, development, and investment services to family office and institutional projects valued at more than $2 billion. His product experience includes office, residential, retail, hotel, mixed-use, and industrial properties, totaling over 3.6 million square feet. As an industry expert, Richard has been referenced in the New York Times and has been a contributing source for the annual Urban Land Institute/PricewaterhouseCoopers publication Emerging Trends in Real Estate. He served on the board of directors of the Pacific Real Estate Institute and is both a past president and former national board director for the National Association of Industrial and Office Properties.

ABOUT TRINITY REAL ESTATE

Trinity Real Estate provides comprehensive, personalized real estate services and investment strategy to West Coast family offices and institutional investors. TRE’s hands-on, high touch, and full-service approach has led to the acquisition, management, development, and repositioning of more than $3 billion in assets since its founding in 2001. These assets span all sectors of the real estate market including office, industrial, multifamily, hospitality and mixed-use. TRE’s objective is to create, enhance, and preserve real estate assets that produce strong long-term returns for its clients.

[1] The information and materials contained in this paper are for informational purposes only and not for the purpose of providing legal advice.

[2] See Trinity Real Estate’s “The Property Sale Process—Best Practices”.

Discover how we’ve helped clients like you on our Case Studies page. Get the latest news on what we’re up to here.