printable pdf format

SECTION 1031 IRS REGULATION - TAX DEFERRED PROGRAM

INTRODUCTION

At Trinity Real Estate, we are passionate about direct investing in commercial real estate. Direct ownership of commercial real estate assets not only offers a well-established means to accumulate wealth, but it can also provide investors with the unique ability to defer taxes that would otherwise be due on gains from a property’s sale.

The process of deferring capital gains taxes on a sold directly owned commercial property is done by “exchanging” the sold property for a newly acquired property. However, the newly acquired property needs to meet the standards defined in Section 1031 of the IRS regulations. The “1031 exchange” can provide material tax benefits resulting in significantly enhanced future income and value. In effect, if you sell a property, and use the proceeds to purchase a like-kind property of the same or greater value through a 1031 exchange, no taxes on the gain(s) are due or payable from the sale.

This is precisely why Trinity Real Estate has advised and guided many clients through the process. Our experience with the 1031 exchange process was recently sourced by the Family Office Real Estate Magazine where we were asked to write an article. You can review this article by clicking on the following link.

To foster your understanding of the 1031 exchange process we provide below a review of the rules, our recommended items for consideration, and client examples of lessons learned along the way.

1031 EXCHANGE RULES

It is very important when implementing a 1031 exchange to have a thorough understanding of all the related rules associated with this process. Missing any one of these can put the transaction at risk to become a taxable event. Several of the 1031 exchange rules are noted briefly below to provide you a feel for their breadth of complexity.

Timing - Once the sale of your existing property is complete, you only have 45 days to identify potential properties to acquire and complete the exchange. In addition, the new property acquisition needs to be completed within 180 days of the closing of the sold property. Although the timing defined in the tax code cannot be changed, it is possible to build more time into the exchange identification process by building Seller closing extensions into the purchase and sale agreement of the property being sold.

Identification – The IRS places limitations on the number and/or value of properties that can be identified – one of the following identification rules must be chosen:

200% Rule: You can identify as many properties as you wish, however, the sum-total of the new properties expected purchase price cannot exceed 200% of the sales price of the exchanged properties; OR

3 Property Rule: You can identify a total of any 3 properties, regardless of their expected cumulative purchase price.

New Property - There are several restrictions that the newly acquired properties require to qualify as an appropriate 1031 exchange. The properties must:

Be on your list of identified properties.

Use at least the same amount of debt that the sold property had at the time of sale.

Be owned by the same entity as the sold property.

Use all the money in the exchange account to avoid taxable income.

Exchange Facilitator - To qualify for a 1031 exchange, all sales proceeds of the exchanged property need to be placed with a qualified intermediary, or Exchange Facilitator, who will hold your proceeds until you are ready to place into escrow for your acquired property. As the seller, you cannot touch the sales proceeds of the sold property prior to exchanging into another property. The Exchange Facilitator firms, or qualified intermediary, need to meet specific IRS requirements. However, these facilitators are not governed by any regulations with respect to the custody of the funds, thus, care should be taken in their selection and account controls.

Use of Exchange Funds – The IRS does not have defined rules regarding the use of exchange funds to cover certain expenses (such as exchange fees, title insurance, attorneys, appraisals, etc.) Your tax advisor can provide guidance on avoiding inadvertently creating taxable income.

Reverse Exchange - If you acquire new property and subsequently sell a different one(s), it may qualify as a “Reverse Exchange”. The same rules apply noted above, however, in reverse:

Once you buy new property, you have 180 days to sell the current one.

The new purchase price must equal or exceed the sales price of the sold property.

The new debt must equal or exceed the amount of debt in the exchanged property.

Since you have, in effect, already identified the property, the identification rules noted above do not apply.

1031 EXCHANGE PROCESS ANALYSIS

Given the potential for significant tax benefits, the rules noted above for a 1031 exchange, and the importance of making sure you are selling for the right reasons, we guide our clients through an extensive analysis before embarking on the process. This analysis includes among other items:

Determining Taxable Gain Estimate – We help our clients to determine the amount of the taxes they would owe if the property were sold. If the tax is not material, we will often advise our clients to re-invest outside the exchange process. This is to avoid the pressure of having to invest within the tight timeframe of a 1031 exchange. In a competitive environment, 1031 Buyers who are up against their exchange deadline are often aggressive buyers, sometimes offering terms they would not normally agree to avoid having to pay the capital gains tax.

Completing Hold/Sell Analysis - Before committing to selling a property, we recommend our clients complete a Hold-Sell analysis to make sure the property is being sold for the right reasons. Our recommended “hold-sell” analysis encompasses some of the following questions:

What are the long-term prospects for the property and the property’s neighborhood?

Is the property still meeting risk/reward objectives for the asset and for the portfolio?

Does the property require more improvement/maintenance capital than what you want or could do?

Is it possible to improve property operations through strategic capital investments and/or management overhaul?

Is the market currently willing to pay you more then what you would pay for the property if it were for sale today?

Once a sale decision is made, we strongly recommend clients to place their property on the market to gain a wide exposure. We advise them to go through a qualified investment sales broker to ensure there is a competitive process and to get the best combination of price and terms.

Completing a Strategic Assessment - We recommend completing a strategic assessment of your goals to assist in understanding the risk and return profile of a potential replacement property. Some of the questions for completing this assessment are as follows:

How much risk are you willing to take?

How important is cash flow?

How much debt are you willing to take on?

What is the diversification and risk profile within your commercial real estate portfolio? (i.e., property type, geography, etc.)

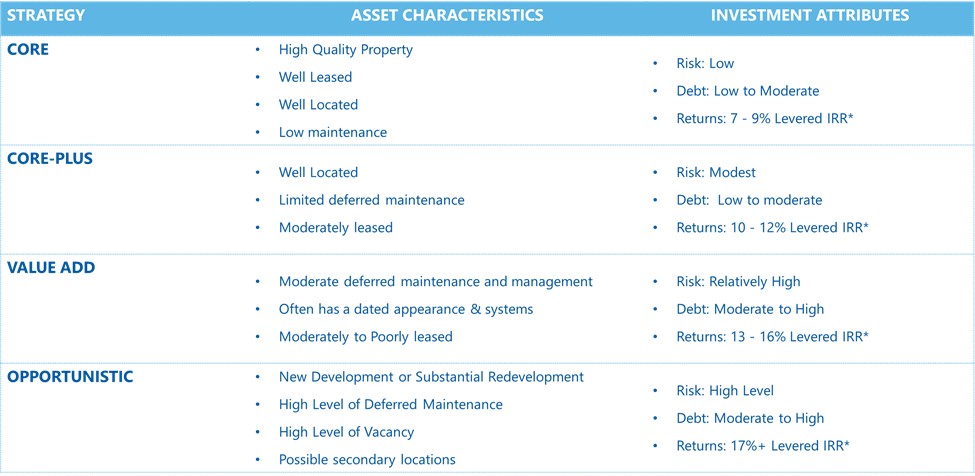

Identifying Replacement Property - Through asking the above questions and assessing the strategic risk and reward objectives, we work with clients to collectively identify the profile of the replacement property or portfolio. Trinity views potential properties by their risk/return profiles: Core, Core-Plus, Value-Add, Opportunistic:

For the clients that are not actively in the market for new opportunities, we recommend enlisting the services of a dedicated professional advisor (like Trinity) who can use their owner and broker networks to help source opportunities that meet their needs.

Underwriting/Due Diligence - Upon identification of the replacement property, we recommend completing a thorough underwriting of the perspective property prior to submitting a purchase bid. This underwriting includes estimates of market rent, operating expenses, capital improvements and encompasses assessing any debt that is needed for acquiring the property. Finally, once a property is under contract, we recommend a thorough due diligence assessment of the property which include among other items the following studies/reports:

Environmental Assessment – A “Phase I” Environmental Site Assessment which can be obtained by a licensed environmental engineer.

Property Condition Report - A report identifying any deferred maintenance or needed expenditures typically within a 10-year period; we recommend finding an advisor with a good reputation and experience in the property type you are acquiring.

Survey – A survey will identify and insure against any encroachments or unwanted easements.

Zoning Report – This report confirms that the property meets current zoning codes and can identify potentially significant issues.

Insurance Review - Use a reputable insurance broker to obtain proper insurance coverage to protect you post-closing.

Creating a Timeline - We collaborate with our clients to create a timeline for the exchange process well in advance of embarking on the effort. This is to relieve some of the pressure of having to invest within the tight timeframe of a 1031 exchange. This often translates to beginning the search for a replacement property well in advance of the anticipated closing date.

1031 EXCHANGE TEAM

Given the complicated nature of a 1031 exchange, we recommend clients contemplating using the 1031 exchange process to have a qualified team. This team should include the following components:

Accounting Firm – The accounting firm will confirm/assist with calculating the depreciated basis and potential tax liabilities of the property being sold and provide advice/confirmation on meeting IRS guidelines.

Legal Firm – The legal firm will assist with all the necessary real estate legal transactional documentation and will be an additional voice in 1031 legal nuances.

Real Estate Broker – The broker firm(s) can assist with selling as well as sourcing new properties.

Real Estate Advisory Firm – A full service real estate advisory (like Trinity) will be able to assist with coordinating all aspects of a 1031 exchange, including the Hold-Sell analysis, oversight of the property sale and acquisition, creation/confirmation of a portfolio strategy as well as execution of the process of underwriting and conducting due diligence on acquisition candidates.

1031 EXCHANGE PROCESS - CLIENT EXAMPLES

We have advised numerous clients in successfully completing new property acquisitions through the 1031 process. While the benefits of the 1031 program are clear, we offer two examples’ of 1031 exchanges with both positive and negative results.

Improve Portfolio Diversification – We were recently engaged by a family office to review their established portfolio, which was dominated by a single tenant building. We completed a “Hold-Sell” analysis on the building and recommended a sale based on potential market pricing. Plus, selling the building would allow the client to better diversify their portfolio. We hired an investment sales team that widely marketed the asset and as part of the sale we negotiated a 6-month closing extension on the sale to allow our client time to find a suitable replacement asset in a competitive marketplace. As a result, we were able to acquire two multitenant properties that better fit the client’s investment parameters and met all the 1031 exchange

Time Pressured Outcome – In the process of reviewing a new client’s direct real estate portfolio, we learned the family had previously acquired two of their properties under duress of the 1031 exchange In both cases the family had not completed a strategic plan and were pressured into buying the noted assets to avoid the taxes otherwise due. The properties purchased were at odds with their risk tolerance and have significantly underperformed. We strongly recommend creating a 1031 strategic investment plan before completing a sale which will assist in avoiding poor real estate investment decisions to avoid taxes.

SUMMARY

In summary, 1031 exchanges are an effective and beneficial way to defer capital gains taxes when selling directly owned commercial real estate assets. The process can be challenging, but with solid planning and an effective team to manage the exchange transaction, it can result in a replacement property that meets the 1031 exchange rules as well as the long-term investment objectives for the investor.

ABOUT THE AUTHOR - RICHARD LEIDER

Over the past 30 years, Richard has provided real estate advisory, development, and investment services to family office and institutional projects valued at more than $2 billion. His product experience includes office, residential, retail, hotel, mixed-use, and industrial properties, totaling over 3.6 million square feet. As an industry expert, Richard has been referenced in the New York Times and has been a contributing source for the annual Urban Land Institute/PricewaterhouseCoopers publication Emerging Trends in Real Estate. He served on the board of directors of the Pacific Real Estate Institute and is both a past president and former national board director for the National Association of Industrial and Office Properties.

ABOUT TRINITY REAL ESTATE

Trinity Real Estate provides comprehensive, personalized real estate services and investment strategy to West Coast family offices and institutional investors. TRE’s hands-on, high touch, and full-service approach has led to the acquisition, management, development, and repositioning of more than $3 billion in assets since its founding in 2001. These assets span all sectors of the real estate market including office, industrial, multifamily, hospitality and mixed-use. TRE’s objective is to create, enhance, and preserve real estate assets that produce strong long-term returns for its clients.

Discover how we’ve helped clients like you on our Case Studies page. Get the latest news on what we’re up to here.